BJY Trends

Stay updated with the latest trends and insights.

Marketplace Liquidity Models Unplugged: Navigating the Waves of Trade

Dive into the secrets of marketplace liquidity! Discover innovative models and strategies to master the waves of trade and boost your success.

Understanding Marketplace Liquidity Models: Key Concepts Explained

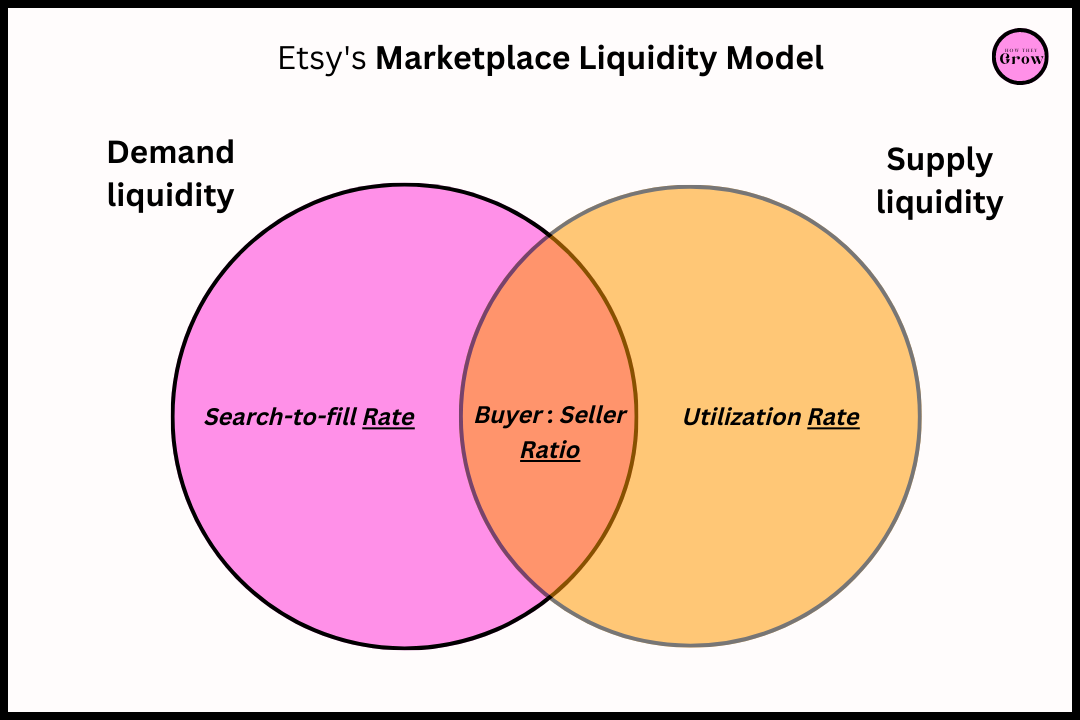

Understanding marketplace liquidity models is essential for anyone involved in trading or investing. Liquidity refers to the ease with which assets can be bought or sold in a market without causing significant price fluctuations. There are various types of liquidity models, ranging from centralized exchanges to decentralized platforms. Key concepts to grasp include the distinction between order book models, which match buyers and sellers directly, and automated market makers (AMMs), which utilize algorithms to set prices based on supply and demand. Familiarizing yourself with these models helps in making informed trading decisions and capitalizing on market opportunities.

In addition to the basic types of liquidity models, it's crucial to understand several metrics that indicate liquidity levels. The liquidity ratio and bid-ask spread are two critical indicators that traders often analyze. The liquidity ratio provides insights into the availability of assets for trading, while the bid-ask spread reflects the difference between the price buyers are willing to pay and the price sellers are asking. By evaluating these metrics, participants can better navigate marketplaces and optimize their strategies, ensuring they operate effectively in various liquidity environments.

Counter-Strike is a popular tactical first-person shooter franchise that has become a staple in competitive gaming. Players engage in multiplayer matches, taking on roles as either terrorists or counter-terrorists. For enthusiasts looking to enhance their gameplay experience, they can utilize various resources, including the daddyskins promo code to get exclusive in-game items and skins.

The Impact of Market Depth on Trading Efficiency

Market depth refers to the ability of a market to sustain relatively large market orders without impacting the price of the stock significantly. A deeper market, characterized by a higher volume of buy and sell orders at various price levels, typically leads to greater trading efficiency. When traders have access to a more profound market depth, they can execute larger transactions quickly and at better prices, minimizing slippage. Furthermore, in a market with significant depth, traders can execute their strategies with less risk of affecting market prices, which is particularly crucial during periods of high volatility.

Additionally, understanding market depth can provide insights into potential price movements. A trading environment with substantial liquidity often reflects a healthy balance between supply and demand. Traders analyzing market depth can better anticipate market trends and make informed decisions. Consequently, a strong grasp of market depth can lead to improved trade executions and optimized overall performance, enhancing the efficiency of trading strategies in both bullish and bearish markets.

How to Assess and Improve Liquidity in Your Marketplace

Assessing and improving liquidity in your marketplace is crucial for ensuring smooth transactions and maintaining a healthy trading environment. To begin with, liquidity can be measured by evaluating the volume of transactions, the speed at which they occur, and the ease with which assets can be bought or sold. A good starting point is to analyze your marketplace's order book, which provides insights into both buy and sell orders. You can also implement metrics like the liquidity ratio, which compares current assets to current liabilities, helping you determine the market's ability to meet its short-term obligations.

Once you have assessed the current liquidity levels, consider the following strategies to improve it:

- Increase user participation: By enhancing marketing efforts and providing incentives, you can attract more buyers and sellers to your marketplace.

- Optimize pricing models: Adjusting pricing strategies can make your assets more appealing, further enhancing liquidity.

- Improve transaction speed: Investing in better technology and streamlining processes can reduce the time it takes to complete trades.